The Us dollar ended the week higher, even though it saw some strong selling on Friday, most likely due to increased prospects for a new US stimulus bill. Risk assets had performed well, recovering from the losses of the previous week, suggesting “risk on” is the market’s sentiment and nothing to worry about. However, the US treasury yields market is not in sync with that view and we think it would be appropriate to talk about it, considering it might signal a growing liquidity crisis.

The short-end of the curve drops

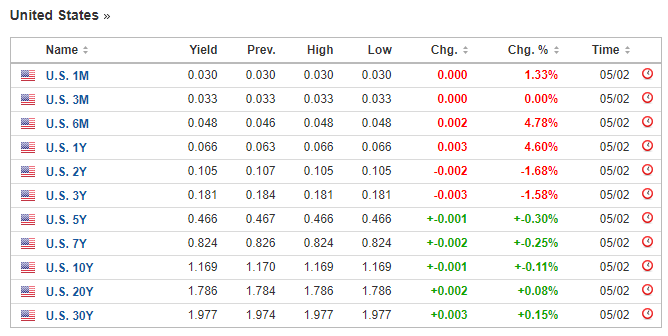

Despite the main narrative of reflation across the major media outlets, the short-end of the yield curve (3m – 3y) isn’t indicative of that. As you can see in the table below from investing.com, short-term yields continue to drop as banks demand treasuries three times the offer at each auction.

It is true that volatility in the FX markets is subdued but in case this will turn into a broader liquidity crisis, the US dollar will spike again and risk currencies will face more downside pressure. On top of the demand from private banks, the FED is also buying treasuries at the same pace, draining the supply even further.

Long yields suggesting a reflation?

On the other hand, treasuries starting with the 5y maturity and posting a completely different performance. Interest rates continue to rise, supporting the reflation narrative. Although down the road the recovery is bound to occur, what many people fail to understand is that the economy will take years to heal and, in the meantime, it will need to get past numerous roadblocks. The main question now is whether the short end of the curve is significant for the broad financial markets in the weeks and months ahead.

Fiscal stimulus bad for banks?

As we already talked about, US prospects improved once the Senate majority shifted in favor of the Democrats. But more stimulus might be dangerous for the economy as a lack of it. In March 2020 there were already talks about fiscal measures and back then the demand for short-term treasuries skyrocketed.

The former US Treasury Secretary Steven Mnuchin managed to prevent yields from falling further into negative by obtaining a provision allowing for the TGA (Treasury General Account) at the Fed to increase.

Things are completely different now that the new Treasure Secretary wants to unwind the TGA at the same time when new stimulus is about to get passed by Congress. The next several weeks could turn out to be increasingly challenging, especially if short-term rates will fall back into negative.