eXcentral Review

eXcentral

Details

| Broker | eXcentral |

|---|---|

| Website URL | https://eu.excentral.com/ |

| Founded | 2019 |

| Headquarters | Andrea Zappa & Makedonon 4, Honey Court V, 1st floor, Office 11A, 4040 Limassol, Cyprus |

| Support Number | +357 24 024022 |

| Support Types | Phone , Email , Live chat |

| Languages | 10 languages supported |

| Trading Platform | WebTrader | MT4 | Mobile app |

| Minimum 1st Deposit | $250 |

| Minimum Account Size | $250 |

| Leverage | Up to 1:30 (retail) and 1:400 (professional) |

| Spread | Variable |

| Free Demo Account |

|

| Regulated |

|

| Regulation | Regulated by CySEC |

| Account Types | Classic , Silver , Gold , VIP |

| Deposit Methods | Credit/Debit card , Wire transfer , Skrill , Neteller |

| Withdrawal Methods | Credit/Debit card , Wire transfer , Skrill , Neteller |

| Number of Assets | 160+ |

| Types of Assets | Forex , Shares , Indices , Commodities , Cryptocurrencies |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score | 96 |

eXcentral is the brand name of Mount Nico Corp Ltd, a successful investment firm, regulated by CySEC (license 226/14) and following the MiFID II directive. The services provided by the broker are designed for traders within the European Economic Area and Switzerland. There are multiple reasons why someone should start trading with eXcentral, including an innovative web-based platform and MT4, highly-trained support, plenty of educational resources, and strong brand values.

Trading with eXcentral means access to 160+ CFD assets, including forex, stocks, indices, commodities, and cryptocurrencies, with different conditions for retail and professional traders, according to the latest regulation. Our eXcentral review will highlight some of the most important features and try to provide an answer for those wanting to know why they should prefer to work with this broker.

Trading Platforms

Specially designed to improve the trading experience, eXcentral’s Web Trading Platform is a client-centric solution integrating multi-view option, risk management tools, advanced charting, and a simple yet effective user interface. The platform works via any browser and can be accessed at any point, without any installation required.

Secondly, at eXcentral, traders will benefit from the popular MT4, still one of the most reliable trading software even after 15 years of existence. Providing interactive charts with 9-time frames, 30 built-in technical indicators, EA compatibility, a great degree of customization, a super friendly interface, and 3 execution modes, this is one of the top choices to trade FX and CFDs daily. Trading forex with the eXcentral MT4 is strongly trending thanks to all the features provided and included.

Mobile trading had not been forgotten at eXcentral as both the Web Platform and MT4 come with app versions, compatible with Android and iOS. This is an absolute requirement considering the increased market volatility and uncertainty at the ֶpresent time.

Account Types

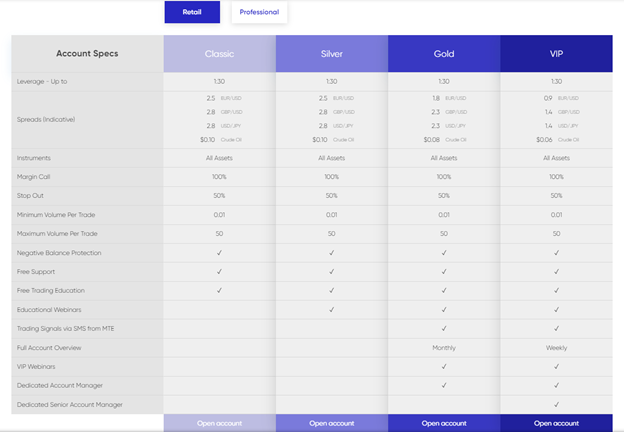

When it comes to the account types, traders can choose from Classic, Silver, Gold, and VIP versions, each with different features available. Also, traders need to keep in mind that they will be categorized as retail or professional clients, based on the latest European regulation.

For retail traders, the maximum leverage is capped at 1:30, while for professionals it goes as high as 1:400 for some of the FX pairs part of the asset list. Classic account holders will benefit from negative balance protection, free support, and trading education.

Only gold and VIP account holders will benefit from features like trading signals, full account overview, VIP webinars, and dedicated account managers. In terms of funding methods, eXcentral accepts deposits via credit/debit cards from Visa or Mastercard, wire transfers, Skrill, or Neteller.

Clients can deposit in USD, EUR, or GBP, with the minimum amount capped at 250 in of the currencies and using any type of deposit. When it comes to withdrawals, the same methods can be used, but it is necessary to pass the verification process by providing proof of ID, proof of residence, a complete assessment of appropriateness, and payment method verification.

Trading Conditions

At eXcentral there are 160+ trading instruments available, ranging from CFDs based on forex pairs (majors, minors, and exotics), 12 different global stock market indices, 19 commodities CFDs, 100+ shares CFDs from top markets like the USA, Germany, or France, as well as 5 CFDs based on cryptocurrencies (Bitcoin, Bitcoin Cash, Ether, Litecoin, and XRP).

The trading conditions available will depend on whether you can qualify for a professional account (you will need to meet the requirements) or you will benefit from a retail account. For the latter, conditions are competitive and mean access to decent spreads, 100% margin call, 50% stop out, 0.01 lots minimum trade volume, and a maximum of 50 lots per trade.

Customer Support

eXcentral puts the customer on top of its priorities and because of that, it has enabled access to multiple communication channels. You can contact a representative via phone, email, or live and ask for information about their services, as well as solve any technical issue. The customer support service benefits from good ratings and it’s yet another reason to believe eXcentral is a trusted brand.

Summary

The bottom line is that we did not find any reason to believe eXcentral might be a suspicious broker, only the contrary. With the CySEC regulation, compliance with MiFID II, and registrations with most European regulators, this is a reliable brand to work with.

eXcentral is compliant with the ICF (Investor Compensation Fund) and ESMA (European Securities and Markets Authority) to ensure customer funds are always safe and secure.

We at 24ForexSecrets believe eXcentral is a broker you can trust and choose at any point, considering it has a diversified trading offer for all types of traders. Keep in mind you must live in EEA or Switzerland to be able to open an account with this company. For more information, visit their official website or use the broker’s customer support service.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.42% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Visit Broker