Welcome to the exciting world of Forex and CFD trading!

’24 Forex Secrets’ is your #1 source for reliable information, to guide through the world of online trading. We have handpicked the right brokers which we consider the safest to start with, that are also offering great bonuses for live accounts, rebates, education center and additional services.

We encourage you to read through our guides, to follow our trading tips and advices and to get updated on related news. Want to be the first to know when we publish a new tip or offer? Just subscribe to our newsletter, and to get the most exclusive offers on the market sent directly to your mailbox!

South Korea’s Return To The U.S. Currency Monitoring List: A Deep Dive Into Its Forex Policy And Global Implications

Introduction In a surprising yet strategic update to its semiannual report, the United States Department of the Treasury has once again placed South Korea on its currency monitoring list, a...

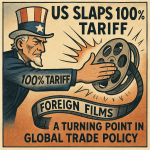

US Slaps 100% Tariff On Foreign Films: A Turning Point In Global Trade Policy

Introduction On May 5, 2025, U.S. President Donald Trump announced a sweeping new tariff of 100% on all foreign films imported into the United States. This dramatic move, introduced during...

Powell’s Hawkish Resolve Jolts Forex Markets: A Deep Dive Into The April 16 FX Wrap

Introduction On April 16, 2025, forex traders were closely tuned in as Federal Reserve Chair Jerome Powell addressed economic stakeholders at the Economic Club of Chicago. While much of the...

European Economic Indicators And The Economic Outlook Ahead Of ECB’s Decision – March 4, 2025

Introduction On March 4, 2025, the global financial landscape experienced notable movements due to the release of key European economic indicators, specifically the February figures for the Consumer Price Index...

Forex Market Update: US Dollar Retreats, Gold Hits Record High As Markets Await US Data

Introduction The global financial markets remain in a state of flux as the US dollar continues to weaken, while gold surges to new all-time highs. Traders and investors are keenly...