The Gross Domestic Product Annualized (Q2) managed to exceed expectations yesterday, showing that despite recent pessimistic comments from various analysts, the US economy continues to expand at a strong pace.

Gross Domestic Product Annualized (Q2) at 3%

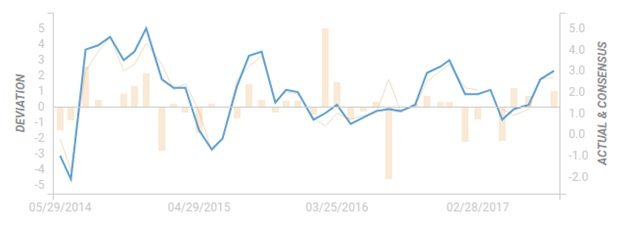

The forecast had been at 2.7% increase, above 0.1% from last figure, but the actual number managed to exceed analysts’ expectations and came out at 3.0%. Statistically speaking the second quarter of the year is the period of the year when the GDP performs better, due to increased economic activity, compared to the winter, when the poor climatic conditions do not foster a growing GDP.

This positive news comes after a series of bad news for the US dollar. Forex trading activity around the US dollar and US equities had been volatile lately, as the CPI figures were revised lower and there were no new hints from the Fed regarding the future path of the monetary policy, or any new information regarding their balance sheet reduction, who was supposed to start this autumn.

It looks like the Fed is aware of the downside risks that are starting to show up and they are trying to keep an easier monetary policy as long as possible.

Forex trading activity in terms of pairs containing the US dollar could be intense in the following days, but risks to the downside still remain. The political conflict between the US and North Korea had not been solved, while concerns over the President Trump ability to implement his agenda to boost economic growth are continuing to rise.

For the last two days, the US dollar managed to gain significant ground against the euro, swiss franc and yen. We’ve seen around two hundred pips gains against the lather two and the move could continue in the short-term if conditions start to improve.

At the end of this week we have another important round of economic data coming out from the US, only this time the focus will turn again on the job market activity, which should create again significant volatility throughout the financial market.

Risk Warning and Disclaimer

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Past performance is no indication or guarantee of future performance.